Why stock investors could benefit from a globally diversified portfolio

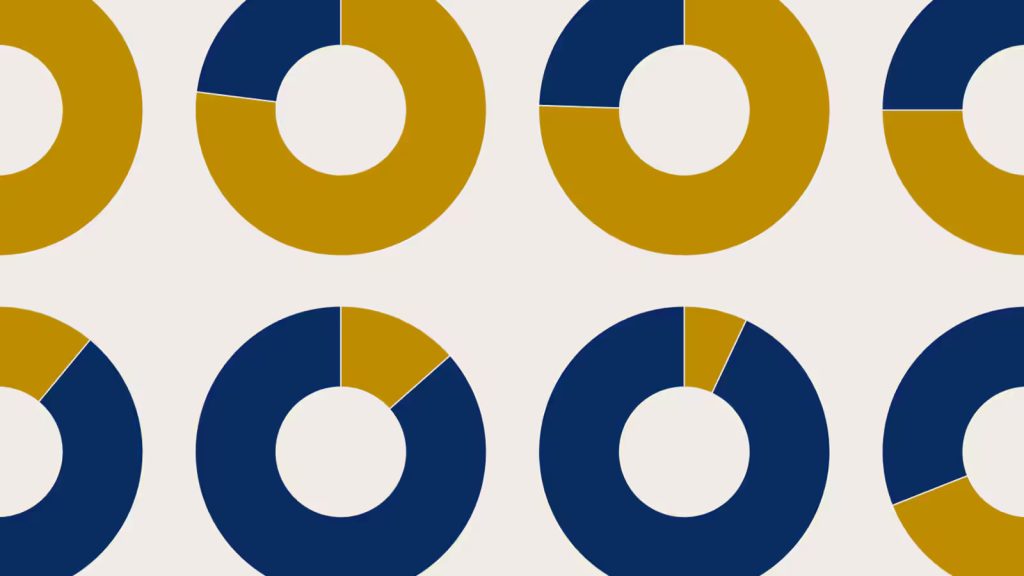

The plunge in stocks after President Trump announced his full slate of tariffs in early April briefly met the definition of a bear market: The S&P 500 fell just under 20% from its high, and the Nasdaq dropped 23%. However, with the US and its trading partners stepping back from the tariff brink and the risk of recession easing, stocks may now be poised for further gains over the next 12 months, Goldman Sachs Research’s Chief Global Equity Strategist Peter Oppenheimer says. It remains to be seen whether global equities have genuinely escaped a bear market. Oppenheimer points out that it’s common for stocks to rally even during a prolonged downturn, and the reasons, or type, of bear market can give investors insight into the potential depth and duration of market declines. It’s still unclear whether the US and other economies will sidestep a contraction. In the meantime, investors may benefit from greater portfolio diversification. While our analysts expect the S&P 500 index of US stocks to rally 10% in the next 12 months (as of May 30), there are signs that the dollar may weaken and there are indications of better opportunities in Europe and parts of Asia, Oppenheimer says. “We had this consistent rise in profit margins in the US in technology companies, but we think now you are beginning to see more mean reversion from high levels of profitability in some areas,” Oppenheimer says. We spoke with Oppenheimer about the different types of bear markets, where equities are trading in the economic cycle, and why portfolios may benefit from diversification in the coming months. How do you look at the brief bear market earlier this year? People think of bear markets as binary — either you’re in one or you’re not. But actually, if you look at history, the data going back to the 1800s, you can differentiate between types of bear markets. They differ by depth and length, but also by the factors that trigger them. We’ve been able to identify three different types. The first type, which we call structural, is the worst type of bear market but fortunately also the rarest. They’re always preceded by asset bubbles of some form or another, usually backed by very high private sector debt. And when these bubbles burst, for whatever reason, it tends to trigger a deleveraging cycle and a very sharp fall in asset prices. And that usually feeds into some kind of problem in the banking sector or the real estate sector or both. The second type is cyclical, and these are the bear markets that oscillate around economic cycles. When investors anticipate a recession, stock prices fall to reflect the potential downturn in activity and profits. And ultimately, they recover as you get some kind of policy response that improves the prospect of an economic recovery. And the third type is event-driven. These are triggered by some kind of shock that derails an economic cycle, such as a war or a commodity crisis. The pandemic was an unusual event that derailed the economic cycle globally and triggered a bear market. To the extent that the recent downturn in equities has been triggered by tariffs, this is event-driven. For an investor, why does it help to know the kind of bear market? Because it helps to set appropriate expectations. In a structural bear market, equities may fall by 50% or 60% over three or four years and take a long time, typically about a decade, to recover fully in nominal terms. Cyclical and event-driven bear markets don’t tend to vary that much in terms of the absolute price declines, typically around 25% to 30%, but the difference is the speed of this decline and the subsequent recovery — event-driven ones are just much quicker. The main difference is whether you get a recession. Sometimes shocks lead to recessions, and what starts out as a temporary drawdown can last a bit longer as that shock morphs into a recession. If this is an event-driven bear market, are we through it? One problem in trying to figure that out in real time is that bear markets of whatever description do incorporate strong rallies. It would be unusual for a bear market to fall in a straight line. We don’t know for sure whether the low in April marked the trough. At this stage we are not certain whether we are avoiding a recession. Our view is that recession risk has definitely moderated because tariffs have largely been wound back for large parts of the world and indeed, most recently, for China. Goldman Sachs economists had forecast the probability of recession at around 45% in the US over the next 12 months, and after the recent pause between China and the US, they reduced that probability to around 35%. That’s still above the usual background risk in any given year of about 15% probability of recession. Are you certain this isn’t a structural downturn? Structural downturns come about from the combination of asset bubbles with a lot of private sector leverage. I think we can put private sector leverage to one side right now. After the financial crisis, banks’ balance sheets strengthened a lot because of tighter regulation. Corporates broadly have very healthy balance sheets. And households still have pretty good balance sheets. On the valuation point, it’s true that the US equity market has a high valuation — well into the 90th percentile if we look at a historical distribution for price-to-earnings ratios. However, it is important that, at least up to now, the very high multiple has been reflective of very strong underlying fundamentals. Profits have been extremely strong in the US over the last decade or so, largely driven by the powerful rise in profitability of the largest tech companies. We don’t think that there is a speculative bubble. Is continued growth in earnings needed, though, to justify the valuations? The prospect of continued earnings growth is partly a function of what happens in the economy

Why stock investors could benefit from a globally diversified portfolio Read More »