US stocks are expected to rally in the coming months as the Trump administration overhauls the country’s tariff policy with its largest trade partners.

The S&P 500 Index fell in early April after the US government announced sweeping “Liberation Day” tariffs, but the index has rallied since then amid delays on the import taxes and signs of progress on trade-policy negotiations. China and the US agreed last weekend to reduce duties for 90 days amid ongoing trade discussions.

“Investors have generally embraced the view that there’s an off ramp for some of these hefty tariffs,” David Kostin, chief US equity strategist in Goldman Sachs Research, says in an episode of Exchanges. “I think that largely is priced in the market.”

How will the Trump administration’s tariffs affect US stocks?

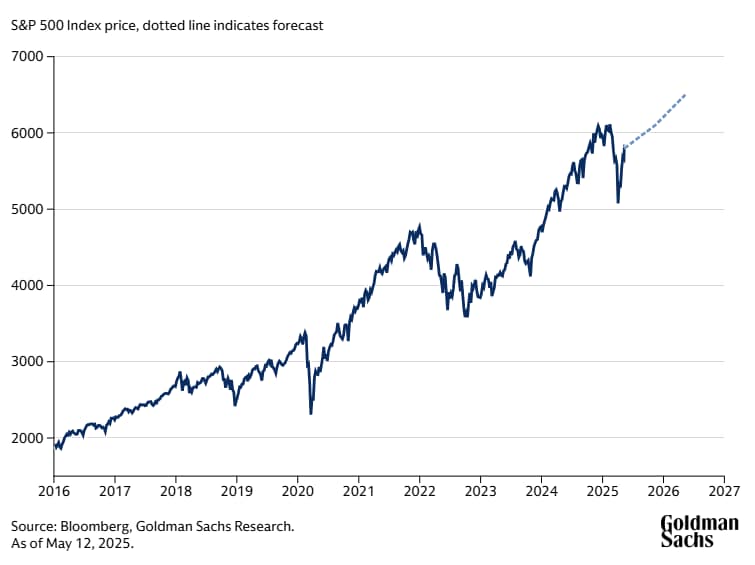

Goldman Sachs Research estimates the S&P 500 Index will increase about 11% to 6,500 in 12 months (as of May 12). The team raised their S&P 500 forecast following the developments in trade discussions between the US and China to incorporate lower tariff rates, better economic growth, and less recession risk than previously expected.

Our economists estimate the US has a 35% chance of recession in the next 12 months and that GDP will expand 1.6%.

“The recent shift in trade policy has reduced the probability of recession,” Kostin writes in a report dated May 12. “However, investors, consumers, and corporate managements will still need to grapple with the economic impact of higher tariff rates and the uncertainty surrounding where tariff rates will land.”

The outlook for US stock earnings

US companies reported 12% growth in first quarter year-over-year earnings, which is substantially higher than the 6% growth analysts had expected. While the strong earnings have given investors some confidence that economic expansion can continue, the first-quarter results reflect a backward-looking period that took place before US tariffs were implemented last month, Kostin says.

“The debate right now with management is ‘who is going to pay the increased tariffs?’” he says.

Investors are assessing to what extent the duties will be passed on to end customers or absorbed by the company or by the supplier. Kostin says those answers will depend on the nature of the industry group and the produce cycle.

“There are certainly greater risks in the second quarter results, both from a revenue point of view — in terms of actual demand and how consumer behavior has been — and the input costs, which may squeeze margins as well,” he adds.

Will US stocks continue to outperform?

“Sentiment right now as we’re experiencing it is, I would say, still pretty uncertain but super engaged,” says Padi Raphael, global co-head of Third Party Wealth Management in Goldman Sachs Asset Management.

“The clients aren’t shying away from the uncertainty,” Raphael said on the Exchanges episode during the firm’s RIA Professional Investor Forum, an audience responsible for $1.3 trillion of client capital. “They’re not paralyzed by fear. They’re highly engaged with the markets, with solutions, and with their clients.”

As trade tensions impact the US economy, the outlook for the “US exceptionalism” investment theme — the expectation for US GDP growth and market returns to outshine other regions — has been a major discussion for investors.

Raphael says sentiment toward that theme differs somewhat around the world. She says US investors aren’t shying away from their domestic market, but at the same time there’s heightened interest in some international markets and in Europe in particular. European investors have an increased bias toward repatriating assets to their home markets.

Generally speaking in Asia, “US exceptionalism and the brand recognition around US companies is still very strong” among many investors, she says. “My recent conversations with investors from that region, from Asia, have not reflected any kind of loss of the shine of the US as a destination for investing,” she says.

A key question is whether investors can find other geographies if they’re looking outside the US. Kostin points out that there have been recent fund flows out of the US to investors’ home markets, particularly in Europe. But the US makes up 65% to 70% of the global equity market, depending on the index.

“The size of the market and the liquidity that’s here means that investors aren’t just going to leave entirely,” Kostin says. But at the same time, investors are eyeing what could be interesting opportunities elsewhere. He notes that some other equity markets are starting from lower valuations and have had better returns this year.

The investment opportunity in private markets

Raphael says private markets, including private equity and private credit, have been a focus for investors. “There is a huge amount of interest from a growing base, a broadening base of individual clients as represented by their financial advisors” in private markets, she says.

Goldman Sachs Asset Management believes “very strongly that individual investors, and particularly high-net-worth individual investors, will benefit from having the same kind of access to institutional-grade investing opportunities that the most sophisticated institutions and the wealthiest individuals have enjoyed for decades,” she says.